I‘m sure it hasn’t escaped your attention but there is a worrying trend on the high street right now as a number of our favourite retailers are going bust.

Well-known brands such as Mothercare, M&S and Waitrose are restructuring and/or closing stores, in an effort to stem a decline in sales. More recently, House of Fraser totally collapsed due to high business rates, sending shockwaves through the business community. But, it has also raised another question as to whether a business rates rise favours online retailers over the high-street?

In 2017, The Financial Times reported that following the increase:

- London shop would see a 14% rise in rates

- Online retailer would face just a 2% rise.

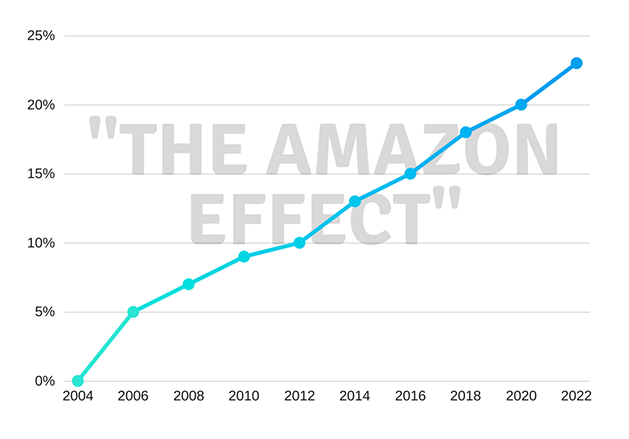

If seeing your competitors going to the wall is making some high street stores nervous, they are also having to contend with the rise of online retailers (or as is becoming known as “The Amazon Effect”).

The convenience of 24/7 online shopping has seen some of our iconic retailers struggle with this change in consumer demand. The rates increase, has also handed online retailers (like ASOS and Boohoo) a competitive advantage as their rates are based on industrial warehouse rates, or a levy cut. This may mean that online retailers yearly profits will continue to be significantly higher than high-street retailers, espcially as they do not require physical retail space.

The graph demonstrates online retail sales as a proportion of total retail sales.

Source: Centre for Retail Research 2018

Predictions over the next 4 years suggest a strong increase, that consumers will ‘window shop’ then buy online (possibly even at a lower price). The increased cost of rates on physical stores especially in Central London, plus the continuous rise in online sales may prove to be detrimental to the high-street. Marks and Spencers, Tesco, and New Look are just a few retailers who have felt the damage that business rates can impose, with M&S revealing plans to close over 100 stores.

It’s not all bad news though, as coffee shops, ice-cream parlours and bookstores have all increased in number. 36% of SME’s believe the government is supporting them enough with business rates relief. Following the 2016 revaluation, the Welsh government offered a £10m relief scheme for retailers facing huge rises in rates. This scheme meant that retailers with rateable values between £6,000 - £12,000 would get a £500 discount. In other words, schemes like such prompt positive responses regarding government support.

Check out our infograph to see the survey in numbers, or try our useful tips and advice in our business library.

We're not a fan of spam either, so we will not pass on your information onto any 3rd parties. What you give to us, stays with us.