Auto enrolment has been with employers now for over 10 years (although for many smaller or new employers this will be a shorter but significant period) and during this period your administrative procedures may have changed.

You may have changed payroll, whether this be internal or external. If so, there are some vital questions that you need to answer including:

- Are you still sending out the correct notices and posting to the right point?

- Are you monitoring all your employees income and age; and sending out the correct notices if their circumstances change?

- When is your re-enrolment window?

- Are you prepared to file the return to the Pensions Regulator and send out the right letters to your employees on time?

- If your scheme has selected a different pensionable salary definition instead of Qualifying Earnings, are you completing the self-certification when required?

- Are you applying the correct tax basis?

- If members are opting out, are they doing so compliantly? We have found that many companies have identified issues with their scheme, upon review. This is often following a change in roles of the key Administrator. If it goes undetected for too long, this can create costly corrections and HMRC issues for the future.

Whilst it is always a good time to audit your scheme it becomes even more critical when your scheme requirements may have changed or other options may be more suitable, such as:

- Your scheme contributions may have increased and form a bigger part of your company budget and that of your employees. You may therefore now wish to select a different scheme design.

- There may be a pension provider with a greater choice of investment options.

- If you initially selected Qualifying Earnings, you may now wish to select an alternative definition of pensionable salary so that salaries are uncapped for pension purposes.

- There is the option of salary exchange/ sacrifice to create savings for the employer/employee or create a valuable employee benefit scheme.

- You can now add Life Assurance benefits with well-being support.

- Or simply re-launch the scheme with the workforce by offering a staff briefing.

- Your scheme contributions may have increased and form a bigger part of your company budget and that of your employees. You may therefore now wish to select a different scheme design.

An Introduction to Salary Exchange

Salary Exchange can create savings and make the scheme substantially more efficient. This may be attractive in light of the recent announcement of increases in employee National Insurance, set for April 2022.

Salary Exchange is an alternative way to structure the payment of contributions to your workplace pension scheme and the way in which your employee pays for pension contributions. Each employee agrees to give up an amount of their gross pay, equivalent to their personal employee contributions. Consequently, the employer will not be paying this sum to the employee but instead

will pay this across to the pension provider as an employer contribution, along with the normal employer contribution payable under the scheme.

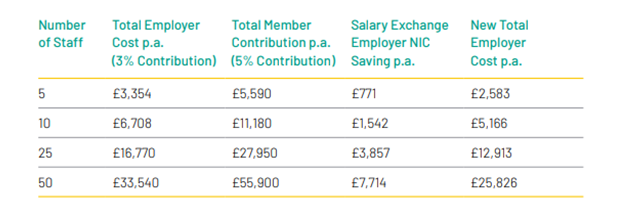

By electing this method of payment, both the employer and employee will save the National Insurance. Some typical indications of savings are shown in the table below.

Based on Qualifying Earnings for Tax Year 2021-22. 3% Employer. 5% Employee

For an employer, this is 13.8% (tax year 21-22) of the total employee existing gross contribution. The example above assumes the scheme basis is Qualifying Earnings, but your scheme structure may be based on full earnings or another definition of pensionable salary and may result in higher (generally) or lower savings.

The employer savings may be retained by the employer or rebate in full or part to the worker's pension. Often the employer will look at the overall package and use this cost saving to pay towards other benefits, such as group life assurance, dental cover or critical illness for their workers; to name a few.

The table previously shown provides examples of the saving in employer cost based on pension contributions in line with the minimum for auto enrolment using Qualifying Earnings basis (likely to be the lowest cost option as only earnings between the lower and higher limit as described earlier). This modelling assumes all employees earn £28,600 (median earnings April 2017, ONS).

If you need assistance navigating the workplace pension scheme, including the most suitable structure whilst maintaining regulatory compliance, reach out to Lawrence Grant today.

We're not a fan of spam either, so we will not pass on your information onto any 3rd parties. What you give to us, stays with us.