Amid concerns over lack of support from the government and fears over mass unemployment, following the recent implementation of the three tiers lockdown rules across the UK, Rishi Sunak brought new hopes to businesses and self-employed workers with the new support packages unveiled yesterday.

JOB SUPPORT SCHEME

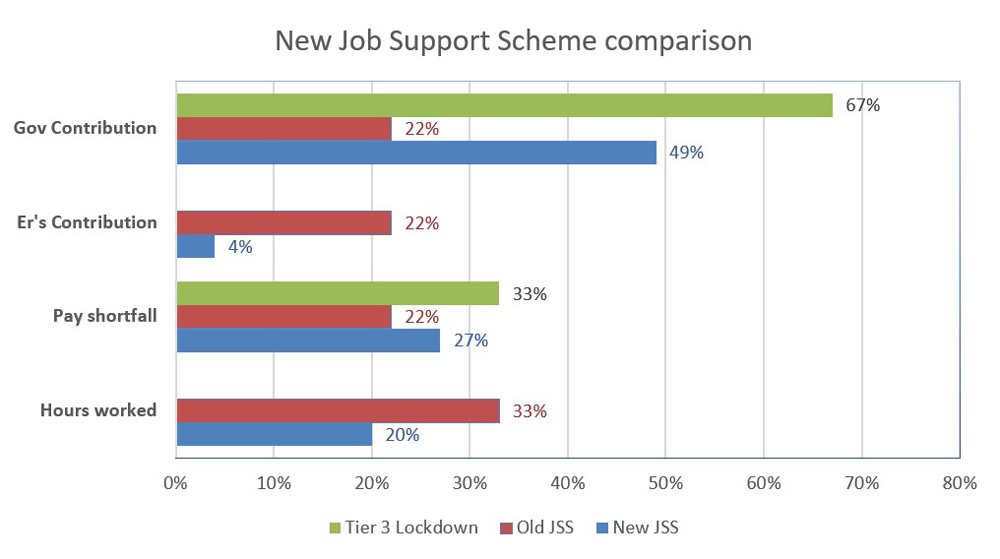

The chancellor has revealed big changes to the Job Support Scheme (JSS), which was announced in the Winter Economy Plan. The revised JSS is split into two categories;

JSS Open – where employers are facing decreased demand

JSS Closed – where employers are legally required to close down their premises.

Under JSS Open, employers will require contributing as little as 4% and staff will require to work just 20% of their normal hours to qualify for this scheme as opposed to JSS Closed, where there is no legal requirement for employers to contribute.

| |

Employers Contribution

|

Government Contribution per month

|

|

Old JSS

|

22%

|

|

22%

|

Capped @ £697.92

|

|

JSS Open

|

4%

|

Capped £125

|

49%

|

Capped @ £1,541.75

|

|

JSS Closed

|

Nil

|

|

67%

|

Capped @ £2,083.33

|

Example 1

Under the new JSS, employees working 20% of their normal hours with a gross monthly salary of £3,125.00 will receive at least 73% of their gross pay.

|

Monthly Gross Pay

|

3,125.00

|

|

|

20% of usual hours

|

625.00

|

20% x £3,125.00

|

|

Employer's contribution

|

125.00

|

(£3,125 x 5% x 80%) capped at £125

|

|

Government Contribution

|

1,541.75

|

(£3,125 x 61.67% x 80%) capped at £1,541.75

|

| |

2,291.75

|

|

|

Percentage of normal pay

|

73%

|

£2,291.75 / £3,125

|

Example 2

For employers who are legally required to close their premises.

Under the new JSS in tier 3 restrictions (JSS Closed), employees with a gross monthly salary of £3,125.00 will receive at least 67% of their gross pay.

|

Monthly Gross Pay

|

3,125.00

|

|

|

Government Contribution

|

|

(£3,125 x 66.66%) capped at £2,083.33

|

| |

2,083.33

|

|

|

Percentage of normal pay

|

67%

|

£2,083.33 / £3,125

|

Additionally, employers can also claim the Jobs Retention Bonus provided furloughed staff are kept on the JSS until the start of February 2021.

SEISS GRANT EXTENTION

The self-employment income support scheme (SEISS) will still remain opened for new applications until 30 April 2021 and the good news is that the first grant under this scheme covering the three months period from 1 November 2020 to 31 January 2021 is now double, from 20% to 40% of the average monthly gross profit and capped at £3,750.

The level of the second grant covering another three months period from 1 February 2021, is yet to be reviewed by the government and will be set in due course.

BUSINESS GRANTS

Businesses in the hospitality, accommodation and leisure sector impacted by tier 2 restrictions will receive cash grant of up to £2,100 per month. This is in addition to the existing £3,000 available to businesses who have legally required to close down its operations. This grant is retrospective and therefore can be backdated to August for businesses operating in areas of enhanced restrictions.

The cash grant is based on the rateable value of the business premises as below;

- For properties with rateable value of £15,000 or under, the grant will be capped at £934 per month

- For properties with rateable value between £15,000-£51,000, the grant will be capped at £1,400 per month

- For properties with rateable value of over £51,000, the grant will be capped at £2,100 per month

Once again, the chancellor has responded promptly and decisively to request from businesses by offering new hopes for impacted businesses and workers.